Introduction

Few economists are expecting the Federal Reserve to cut the federal funds interest rate this week at the upcoming FOMC meeting. Most are expecting the Fed will cut at the September meeting. Many expect that cut to be followed up with another cut in in either October or December. For the record, my summer forecast assumes a 25 BP cut in September and other 25 BP cut in October. Those assumptions, however, are being reconsidered. The possibility of no Fed rate cuts this year is now on the plate for analysis.

The Argument for No Further Fed Cuts in 2025.

Recent data has shown that labor markets are slowing softening from a strong position, and inflation has not edged up – even with tariffs in effect. If labor markets average less than 135K net new jobs monthly for the next three months and inflation remains subdued, a September rate cut is assured. Indeed, a recent survey of economists puts the odds of a September cut at 100%. The one thing I know is, if 100% of economists agree on something, bet against it.

My reasoning to lean against the consensus and consider the possibility that there will be no further cuts in the federal funds rate until next year is based on three factors including; 1) upcoming data that is likely going to reveal elevated inflation, 2) the prime Federal Reserve objective is fighting inflation and labor market strength is secondary, and 3) high levels uncertainty that raise the stakes on a Federal Reserve mis-step.

Dismiss the possibility of a rate cut this week. The Federal Reserve is clear that its monetary policy decisions are going to be data driven. Tariffs and their secondary impacts are the most critical near-term concerns facing the economy. Tariffs’ potential adverse impact takes time to be revealed in the data. Insufficient information will be in-place for a decision to cut rates. As a result, the Fed will sit.

After this week, the next FOMC meeting is held in mid-September, then again in late-October, and once more in early December[1]. By the September meeting more data will become available. The June, July and August jobs and inflation reports will be available. The tariffs impact on the economy will begin to emerge by that point. In addition, it is possible that Congress could reach agreement on the Big, Beautiful, Bill (BBB) regarding tax reform. This potentially adds to expected future inflation. If the data during this period shows any of the following, it is unlikely there will be a rate cut:

· If there is an upturn in the inflation rate there will be no rate cut. Depending on the magnitude of the increase in inflation, and the stability of the labor market, a rate increase cannot be ruled out.

· If there is no significant deterioration in the fundamentals of economic growth, or in the labor market, there will be no cut.

· If the BBB is passed and it is deemed to hold significant inflationary potential, the Fed will struggle to reach a decision endorsing a rate cut.

Keep in mind, there is a good bit of uncertainty surrounding the direction of inflation, economic growth, and the labor markets. Uncertainty clouds the Fed’s ability to forecast economic conditions with confidence. When inflation, employment, or growth trajectories become difficult to predict—due to factors like trade tensions, geopolitical instability, or erratic fiscal policy—the Fed often adopts a cautious stance.

As Fed Chair Jerome Powell recently noted, “heightened uncertainty” stemming from shifting trade policies and inflation dynamics has made it harder to assess the appropriate path for interest rates. In such an environment, the Fed tends to prioritize patience and flexibility, rather than acting preemptively. The cautious and flexible stance preferred by the Fed is to sit.

Three factors must combine to knit together a scenario whereby the Fed cuts rates. These factors include; 1) no significant inflationary impact is observed in the data originating from the tariffs, 2) inflationary expectations in the near future muted and 3) the economy demonstrates continued softening and monthly labor markets show net job creation below 135,000 net new jobs or less.

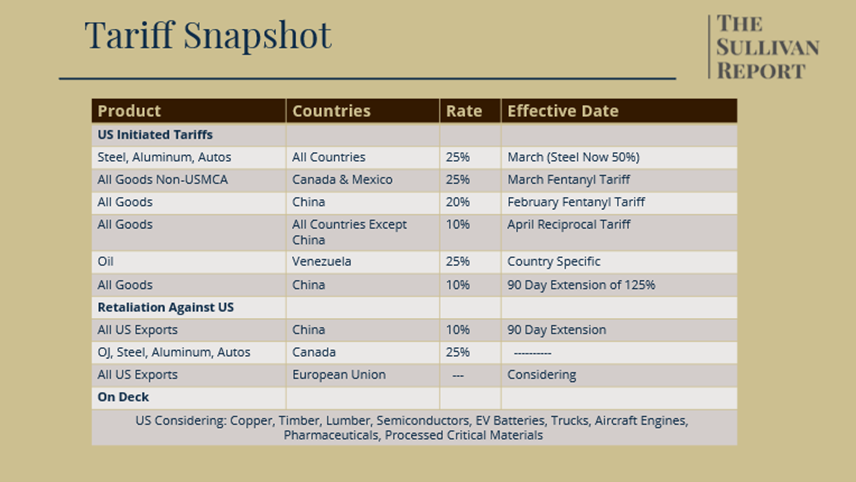

That is a lot to ask for a September Fed rate cut that seems to be etched in stone by the consensus of economists. The issue comes down to what the data will show over the months leading up to the September meeting. Despite “successful” negotiations with our trading partners, compared to the start of the year, higher tariffs will remain in place (the effective tariff rate is currently estimated at 14%). With tariffs, the landed cost of imports will increase.

How much of that translates into higher prices depends on how much is absorbed by the importer. If the added costs are completely absorbed by the importer, there is zero inflationary impact. A recent Federal Reserve survey showed that so far, 77% are passing the added costs onto consumers (23% absorption).

Taking into consideration the specific tariffs imposed on countries and products, my rough estimate is that given time, inflation will be boosted by nearly 150 BP by year-end (from 2.4% to 4.0%). If that is remotely accurate, it will begin showing up in the inflation data in-time for the September meeting. While the economy is also expected to weaken by the next FOMC meeting, labor market weakness will take a bit more time to materialize and net job gains may not fully reflect the weakness in the economy.

Showing heightened inflation, the Fed to sit again. One month’s additional data is probably not going to change the Fed’s mindset a month later. The Fed could easily sit again in October. That leaves only the early December meeting for a possible cut. Having done nothing to intercede, the tariff impacted inflation will likely not improve. Finally, the Senate is hoping to pass the Big Beautiful Bill by the fourth of July. This tax cut will probably add concern about future inflation levels and could further diminish the likelihood of a Fed rate cut.

What This Means for Construction

If all this comes to play, Federal Reserve rate cuts may not materialize until 2026. Furthermore, the Big Beautiful Bill could stimulate the economy enough to provide shelter for the Fed to actually increase rates. Admittedly, the odds of a rate increase are remote but that possibility cannot be completely dismissed.

Private construction activity will not strengthen until interest rates come down in the context of relatively strong labor markets. The prospects of higher inflation, larger federal deficits, a decline in the dollar’s status as a reserve currency all place upward pressures on interest rates. This, coupled with the likelihood that the Federal Reserve will take a careful and prudent approach by waiting on data before initiating policy, suggests monetary policy will not be quick to lower rates.

The Sullivan Report forecast released in March contains two, 25 BP rate cuts this year (September and October). Further cuts were envisioned in 2026 – leading to a modest private sector construction recover in the second half all 2026. Even with those cuts, The Sullivan Report’s projection for the rate of decline in 2025 cement consumption was double that of consensus. If this more passive Fed policy position is incorporated into the scenario, the rate of decline in 2025 cement consumption could be more than originally expected and could also adversely impact the outlook for 2026.

Final Note: The Sullivan Report publishes regularly on Substack. These articles concentrate on the general economy, the construction market, as well as the cement and concrete industries. The Substack reports do not offer explicit forecasts, or detailed assessments on the construction fundamentals. To get that insight you have to subscribe to the Cement Outlook Report. It is a separate report from Substack. It is a detailed, forward-looking outlook for the construction industry. Compared to the consensus of forecasts for the US cement industry, the Cement Outlook Report forecast is more pessimistic for 2025. Taking this more guarded viewpoint into consideration could have a significant contribution on your business strategy.

If your business planning efforts are important, and you are in the cement or concrete business, perhaps you should subscribe to the report published by the most seasoned forecaster in the US cement industry. Go to The Sullivan Report’s website thesullivanreport.com and click subscriptions. Upon subscribing, you will get the latest forecast, alternative scenarios, and power point presentation. And then, the forward looking information and insights will keep flowing. I look forward to having you join as a new client.

[1] The Federal Open Market Committee votes to determine the Federal Funds rates.

Next FOMC meeting is end of July but I agree there is no visibility for a rate cut on the horizon.