Tariffs Nudge Economy Toward Recession

Sweeping tariffs add to inflation, weaken GDP and the job market.

Tariffs Nudge Economy Toward Recession

Sweeping tariffs add to inflation, disrupt supply lines, weaken GDP and the job market.

Overview

The economy’s strength is waning. Even prior to the tariff announcements, evidence suggested that the economy was drifting to a slower growth path. Job growth, a principal source of the economy’s strength over the past few years, has slowed. During the first quarter, an average of 174,000 net new jobs were created monthly - nearly 100,000 lower from a year earlier.

There are other data that suggest an easing in economic growth. Uncertainty is rising among consumers and businesses. Many consumers are struggling to keep up with inflation. Defaults on credit cards, student loans, and mortgages are rising. This all paints a picture of a slowdown.

Near term, tariffs hold significant adverse impact on near-term economic growth. These policy initiatives arguably hold the potential for heightened longer term growth. For now, let’s only focus on near-term impacts and how they relate to the prospects of an economic slowdown. While these tariffs could be negotiated down, for this analysis, the public announcements are taken at face value.

Understanding the Administration’s Rationale

For years, according to the Administration, US industry has been competing on a playing field that is not fair. It is tilted against domestic manufacturers in the US market and abroad. This tilted playing field, according to this thinking, is responsible for the large $1.2 trillion US trade deficit, the decay in the number of manufacturing jobs, and manufacturing plant shutdowns.

This mantra has been around for quite some time and was widely talked about in the 1970’s as Japan’s manufacturers snatched higher market shares to the detriment of domestic producers. Interestingly, back then, many democrats were singing the song of protectionism and local content laws for the protection of automotive industry.

Unfair mercantilist policies enacted by our trading partners, the Administration argues, is the reason domestic manufacturers have ceded market share in the US to foreign competitors. Large US trade deficits are evidence of this inequity.

Unfair trading partner policies include:

· Protective tariffs that insulate their domestic industry from the rigors of competition from US products,

· Subsidies and favorable tax policies that enhance their industry’s competitiveness,

· Collaborative research that can accelerate product and manufacturing efficiencies and is outlawed in the US by anti-trust laws,

· Value added taxes that can dramatically raise the cost of US product in the local marketplace,

· Customs processes that slow down the entry and cost of US products,

· Currency manipulation that can lead to artificial cost advantages their exports and raise the price of US made products in the local market.

The Administration argues that the United States has tried to address these issues over the years with its trading partners - to no avail. Given the failure of negotiation, the Administration has embarked on a new tariff regime levied against nearly all countries and covering most goods.

Another Take on Trade Deficits

These trade inequities exist among some of our trading partners. They have contributed to the burgeoning trade deficit. But there are other reasons for our large deficits and erosion of our industrial base. In some instances, for example, our trading partners hold large cost advantages over US made products – even without the distortions in free trade cited by the Administration. Countries characterized by cheap labor, for example, will probably enjoy cost advantage for products that require a lot of labor to produce. At the end of the day lower production costs and higher profitability are also a principal reason for the large trade deficit and the maladies that are associated with it.

Being the world’s reserve currency also contributes to the trade deficit. While the US has a large trade deficit, called the current account, it also has a huge surplus in the flow of finances, called the capital account. These balances nearly offset each other. When they don’t the value of the dollar changes until they are brought back into balance.

As a financial safe haven this creates an extra demand for our financial assets – boosting the value of the dollar. The stronger dollar makes exports more expensive to buy overseas and imports cheaper. This creates an even larger trade deficit - economists refer to this as the “Triffin Dilemma”.

Our very large Federal deficits are linked to the large trade deficits. When we spend more in federal dollars than we take in, we borrow. US debt is so attractive from a risk point of view it is purchased – by Americans and foreigners. Foreign demand adds to the current account – strengthening the dollar and worsening the trade deficit.

How the New Tariff Rates Are Calculated

The United States Trade Representative (USTR) stated that it is virtually impossible to review each countries trade practices for every product imported or exported. As such, the USTR embarked on an easier, more convenient way to measure the degree of imbalance among its trading partners. At the crux of the calculation the size of the trade deficit. It is “the” measure used to determine degree to which a trading partner has engaged in unfair practices. Consider the following steps to calculate the tariff applied to a specific country:

· For each country the trade deficit is calculated.

o The trade deficit is the value of US exports minus the value of US imports.

· The value of the country’s exports to the US is divided by the total deficit. This yields a percentage. That percentage is considered the trading partners’ penalty imposed on US products either by tariffs or non-tariff barriers.

· According to the formula, if everything was fair there would be no trade deficit. To the extent that there is a deficit, that percentage of net exports is the USTR’s estimate of tariff and non-tariff barriers levied against US manufacturers.

o In the preceding table, this is the calculated “Tariffs Charged to the U.S.A.”

· To be “fair” the Administration cuts the estimate of “Tariffs Charged to the U.S.A. in half. That is the tariff placed on all products from that country entering the United States market.

o In the preceding table, this is the “U.S.A. Discounted Reciprocal Tariff “rate.

· For the countries in which the US had a trade surplus, this formula didn’t work as planned, and a 10% tariff is imposed – for good measure.

Well, the USTR is correct. It is virtually impossible to review each country’s trade practices for every product imported or exported. Their calculations for tariffs levied against 90 countries, however, leave a lot to be desired. The calculations do not remotely reflect potential inequities in trade with each of our partners.

The Economic Impacts

While these new tariffs may be part of a negotiating strategy, for the purpose of identifying the threat these tariffs pose to the economy, let’s treat them as at face value. Any retrenchment in the announced tariffs would brighten the economic outlook. Likewise, trading partner retaliation aimed at US exports would darken the economic outlook.

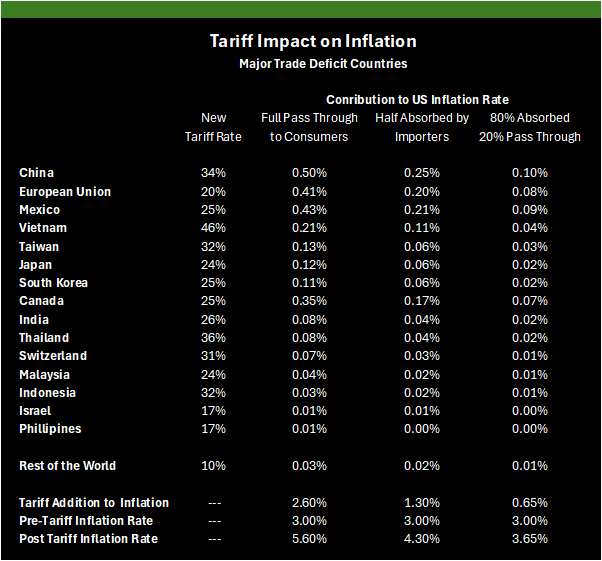

Inflation Impacts: The cost of bringing an imported product to market, as a result of the tariff, will increase by the size of the tariff. Some of that cost increase will be passed on directly, dollar-for-dollar by the importer in the form of higher prices. In other instances, the importer may partially or fully absorb the added cost associated with the tariff – limiting the price increase to the detriment of profits.

The 15 largest trade deficit trading partners account for the entirety of the total US trade deficit. The United States enjoys a neutral or trade surplus with the remaining nations. Assuming a full pass through of the tariffs onto consumers, it yields an increase in US inflation from roughly 3% currently to as high as 5.6%. Depending on the assumptions made regarding the absorption of costs – inflation increases between half a percentage point (the inflation rate increases from 3.0% to 3.5%) to two and a half percentage points (the inflation rate increases to 5.6%).

This calculation does not include the likelihood that domestic manufacturers will raise prices as the tariffs provide shelter to increase prices more aggressively without sacrificing it competitive positioning. Such a phenomenon is likely and will add further to inflation.

GDP Growth & Employment Impacts: GDP will be adversely impacted by higher prices. Higher prices will steal strength from consumers when they are already struggling. The tariffs could reduce economic growth by at least 160 basis points – enough to push the economy into a retreat this year. This translates into a reduction in job growth by 1.0 to 1.6 million jobs by the end of 2025.

Trading Partner Retaliation Impacts: The foregoing estimates do not include the adverse impact associated with trading partner retaliation. While Canada has imposed qualified tariffs specifically on US automotive trade, thus far, China is the only country that has responded with broad tariffs. It is likely that the European Union will eventually respond. The China tariffs alone could reduce US exports by $50-$100 billion and cost at least 100,000 jobs.

Final Note

The size of the trade deficit is a bit more complicated than an uneven playing field as postured by the Administration. Let’s be clear, do not dismiss the fairness issue. Give credit to the Administration for recognizing and addressing it. Arguably, the tariff tact is not a good approach and will lead to US and global economic hardship, and damage our political relations worldwide. There are more thoughtful and comprehensive approaches that might better address the trade deficit and its maladies.

At face value, the tariffs hurt the US and global economy. The preliminary estimates in the report are rough. They serve a purpose, however, in putting the economy’s current story into perspective. Given the economy’s gradual ceding of strength that has materialized since the beginning of the year, the new round of tariffs will add significantly to inflation, lead to significant job loss, and push real GDP growth into negative territory.

The temptation is to say this will all result in recession. It won’t. It’s worse. This malady of ills, high inflation and rising unemployment, is stagflation. At the beginning of the year, I expected a mild form of stagflation. With the tariffs, it is likely to be much more severe.

Frankly, the tariff calculations levied by the Administration are so remedial I suspect they only serve as a starting point to re-open negotiations for better terms of trade with each of our trading partners. In other words, these tariff announcements may be just the first step in “the art of the deal”.

To date, several countries have reportedly begun negotiations with the US on their trade policies. The potential of a time extension of the effective implementation date of tariffs – adds time for more countries to step forward, negotiate, and potentially avoid tariffs. While the focus of this report is assessing the impact of tariffs at face value on the economy - the art of the deal may be at work. Every negotiated retreat from the proposed tariff levels, adds one ray of light to a dark near-term outlook.

To find out how the Federal Reserve might respond and the outlook for interest rates, subscribe to The Sullivan Report. The Sullivan Report is a regular (weekly) report that looks at key forces working in the economy and provides insight hoping that business and individuals can make better respond decisions.

Brief Bio

Ed Sullivan has held senior level positions at the Portland Cement Association, Chase Manhattan Bank Economics, Standard & Poor’s, and Wharton Economics. Ed has lectured at The War College, Fordham University, Fairfield University, Manhattanville College, Villanova and St. Joseph’s University. The Chicago Federal Reserve has cited Ed for his forecast accuracy. While at the CIA, Ed has played supportive analytical roles in major US trade policy including Japan's Voluntary Automotive Export Restraints and NAFTA.