Introduction

All forecasts contain risk. Risks can originate from the data used, the process of calculations, the assumptions, or a combination of each element. Indeed, an infinite number of alternative scenarios to the Baseline exist – each materializes with even small changes in assumptions.

The risks surrounding the Spring Forecast are extremely high. The risks center on assessments regarding underlying strength of the economy and the headwinds that face the near-term economy. The key assessments include: 1) the impact of administration policies on the economic fundamentals, 2) Federal Reserve monetary policy actions, and 3) the strength and resiliency of consumer spending.

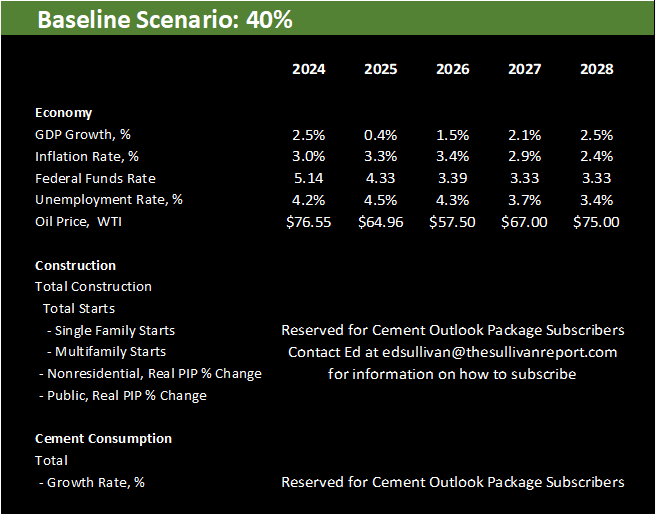

The Baseline Scenario

The “Baseline” forecast is believed to be the most likely scenario that will unfold. The Baseline Scenario has been presented in detail to our subscribers in the Cement Outlook Report. To recap, the Baseline Scenario suggests that the economy’s strength is easing. Uncertainty, tariff policies, immigration reform, and DOGE all add to the near-term economic easing.

Tariff policies hold the prospects of adding significantly to inflationary spirits in the economy. Given the dilemma of rising inflation and weakness in the labor markets, the Federal Reserve may be slow in cutting rates to avert an economic slowdown. Only after the threat of a significant decline in economic growth raises its head, will the Federal Reserve act to lower interest rates.

A lot of time will likely pass for all that to happen and timing is everything. Eighty percent of all construction activity is typically completed by the end of the third quarter. The Fed might only be starting its rate cuts at that time. Once the Fed makes a cut, don’t expect immediate results. Economists estimate the lag as long as 18 months.

Adverse economic momentum, once in place, is hard to reverse. Initial steps by the Federal Reserve to lower rates will likely be modest. This all implies a policy of too little, too late to prevent a significant slowdown for the US construction markets in 2025.

Without sustained strength in the labor market and significant declines in mortgage rates, the residential sector is not expected to improve this year. Adverse affordability conditions will continue as long as mortgage rates remain high. A significant retreat in mortgages rates, to the 5% to 5.5% level, must materialize before the outlook for single family construction turns rosy. Don’t expect that to happen until the second half of next year. In the meantime, weakened labor markets will add further to the woes facing the single-family construction activity.

The nonresidential sector is expected to be hampered by reduced net operating income (NOI) that accompanies a weakening economy. Vacancy rates are high. Leasing rates in many areas are discounted. In the context of a weakening economy, these conditions are expected to worsen. These adverse factors affecting the cyclical sectors of nonresidential construction activity (office, hotel, and retail) are expected to more than offset the positives associated with data centers and onshoring.

Finally, public sector construction activity is expected to be hindered by weaker labor market conditions that typically translate into weaker revenue collections at the state level. This impact also implies less commuting and fewer vehicle miles travelled (gas tax revenues). Second, federal funding programs are denominated in nominal dollars. High inflation levels have eroded the potency of these programs. Third, according to some there exists a shortage of civil engineers to execute infrastructure construction needs. Finally, DOGE efforts to streamline government could also impact public construction contracts and activity.

Note: Cement consumption, according to this scenario, declines to a level below 100 million metric tons – a level not seen since 2019. Our assessment regarding the amount of that decline and the rate of recovery is reserved for subscribers to the Cement Outlook Package (not a Substack option). Contact Ed at edsullivan@thesullivanreport.com to find out how to subscribe.

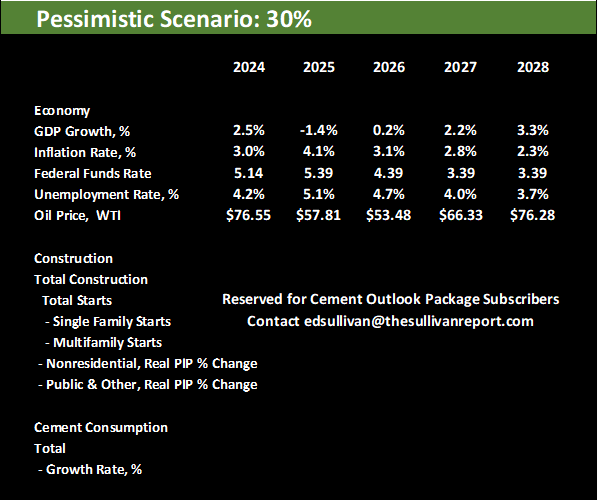

Pessimistic Scenario

The Pessimistic scenario reflects a greater adverse impact on the economy arising from tariffs. While some process is made in negotiations with our key trading partners, for the most part the prospect of high tariffs levied against our trading partners remains in place. Retaliation materializes. Not only from China, but the EU as well. It should be noted with the recent news of progress in negotiations with China, the likelihood of this scenario materializing has been reduced.

This scenario suggests fuel is added to inflationary pressures. Not only do tariffs add to inflation, but under this scenario, supply-chains are disrupted. Inflation tops 5% by year-end.

Given the choice of fighting inflation or unemployment with monetary policy, a recent survey of Federal Reserve governors suggests that fighting inflation is the number one priority. This suggests, that rather than cutting rates, the Federal Reserve raises rates in reaction to the inflationary spirits. Because the supply-chain has been disrupted, high inflation may stay around longer than many expect. If so, that means it will likely not be just one rate increase.

These rate increases come in the context of an economy already slowing, and now disrupted by tariffs, and DOGE. While policies such as tax reform and reduced regulations suggest positives to economic growth – these potential benefits will not materialize anytime soon.

A moderate recession ensues. It begins in the second half of 2025. It deepens through the first half of 2026. Altogether, the recession lasts the better part of a year. Unemployment tops 5%.

Credit conditions tighten for all borrowers including consumers, potential homeowners, and real estate investors.

The tariff acts as a major impetus in bringing about the US recession. A global economic disruption ensues. In addition, the dollar’s prestige declines and loses some of its status as the world’s reserve currency. These factors add to economic weakness in the US and at the same time reduces the rate of decline in inflation and interest rates.

Residential construction is hindered by a continuation of high mortgage rates. In this scenario, a softer labor market also steals strength from residential activity. Multifamily construction is characterized by rising vacancy rates, reduced leasing rates and net operating income declines. Nonresidential construction declines significantly. Finally, the weak labor market hurts revenue collections at state and local governments. The Highway Trust Fund requires greater financial assistance. While weak economic conditions may add to the likelihood of a generous replacement of IJIA, the market impacts may not appear in force until 2027-2028.

In reaction to this decay in the economic environment, inflation pauses, and then retreats. Slowly at first. Inflation expectations decline as economic conditions worsen. The Federal Reserve begins yet another policy pivot – and begins to cut rates in the first half of 2026.

Cement consumption, according to this scenario, declines significantly. Our assessment regarding the amount of that decline is reserved for subscribers to the Cement Outlook Package (not a Substack option). Contact Ed at edsullivan@thesullivanreport.com to find out how to subscribe.

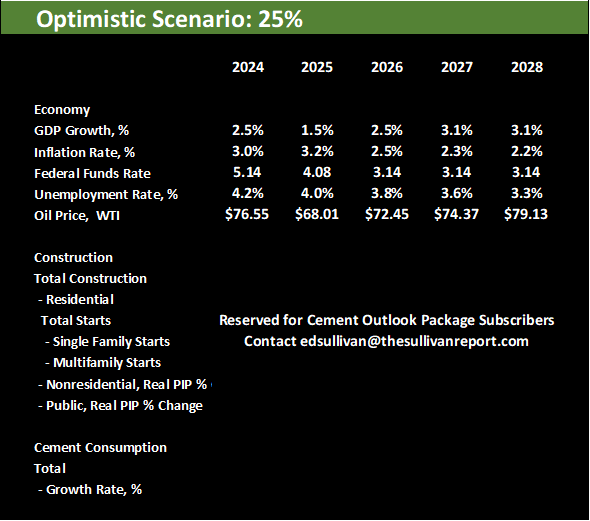

Optimistic Scenario

In the Optimistic Scenario the economy’s resilience is maintained. The “art of the deal” is successful. All trading partners negotiate and agree to terms that are favorable to the US. This happens quickly thereby reducing economic uncertainty. The adverse economic impacts

associated with the tariffs are dramatically reduced. Consumers’ and businesses’ trust in US policy is restored. Consumer and business sentiment swells. It should be noted with the recent news of progress in negotiations with China, the likelihood of this scenario materializing has been increased.

With the tariff’s inflationary threat reduced, the Federal Reserve cuts rates. The policy rate cuts and lower inflation premiums prompt declines in interest rates. Renewed confidence in the

Administration’s economic policies lead to increases in hiring. Investment accelerates. Uncertainty is replaced with confidence.

Stronger job and income growth, along with the mortgage rate dropping below 6% by year-end 2025, supports a stronger near-term single family construction outlook. With no job losses, vacancy rates ease, and rent growth is stronger compared to the Baseline Scenario. Net operating income is much better and as a result tighter lending standards does not act as a significant deterrent to construction. Multifamily starts improve compared to Baseline levels.

The nonresidential construction recovery accelerates under the Optimistic Scenario. With job and income gains, commerce increases and leads to stronger business earnings. Net operating conditions for commercial real estate are stronger. Access to credit is easier under this scenario compared to the Baseline Scenario.

Job market strength under this scenario translates into increased state revenue collections. States fiscal conditions improve. State construction spending is increased. In addition, the fiscal strength reduces the likelihood of state sterilization. Under this scenario, state sterilization of IIJA programs is reduced from 20% to 15%.

In the Optimistic Scenario, cement consumption records growth throughout the forecast horizon. Declines in interest rates ushers in a modest recovery in private sector construction beginning in the second half of 2025. Stronger successive gains follow in the subsequent years. Our assessment regarding the amount of the increases is reserved for subscribers to the Cement Outlook Package (not a Substack option). Contact Ed at edsullivan@thesullivanreport.com to find out how to subscribe.